Achieving price parity between electric vehicles and internal combustion cars is generally seen as a key objective for EV makers, and for good reason.

When America's average price for a new EV matches the average price for a new ICE car, it means that one key obstacle toward EV adoption will have been removed. The day a Toyota Corolla costs the same as a Tesla Model 3, we will see many buyers migrate from the Japanese sedan to the American EV.

But how far are we from EV price parity? According to Kelley Blue Book's November average transaction price data for new vehicles, we're slowly getting there—but only as far as 2023 is concerned. The next year brings a lot of uncertainty as many EV models are losing the federal tax credit.

The average price paid in the U.S. for a new electric vehicle in November was $52,345, whereas the industry average price—all types of propulsion combined—was $48,247. The average transaction price (ATP) for EVs was therefore 8.5% higher than the overall ATP. Mind you, EVs were actually closer to price parity in October, when the EV ATP was $51,715 while the overall ATP was $47,944 (a difference of 7.8%).

It's also worth noting that the rise in EV ATP last month happened despite the fact it was "supported by incentive levels well above the industry average," according to KBB. More specifically, EV incentives in November reached their highest point of 2023 at 8.9% of the average transaction price (ATP); a year ago, EV incentives were less than 2% of ATP.

"In recent months, price parity between EVs and ICE has almost seemed possible," said Stephanie Valdez-Streaty, director of Strategic Planning at Cox Automotive. "It is a complicated measure with plenty of variables, but newer products and higher discounts have brought down average EV prices, even before potential tax incentives. A year ago, the EV premium was more than 30%. Today, it's less than 10%."

KBB did not reveal what the ATP for ICE cars was in November; its data did include the average purchase price for hybrids/alternative energy cars, which was $49,680. Still, since the vast majority of new-vehicle sales in the U.S. consists of cars powered by internal combustion engines (including hybrids), the gap in average prices for EVs vs ICEs was actually higher; unfortunately, we don't know the exact percentage.

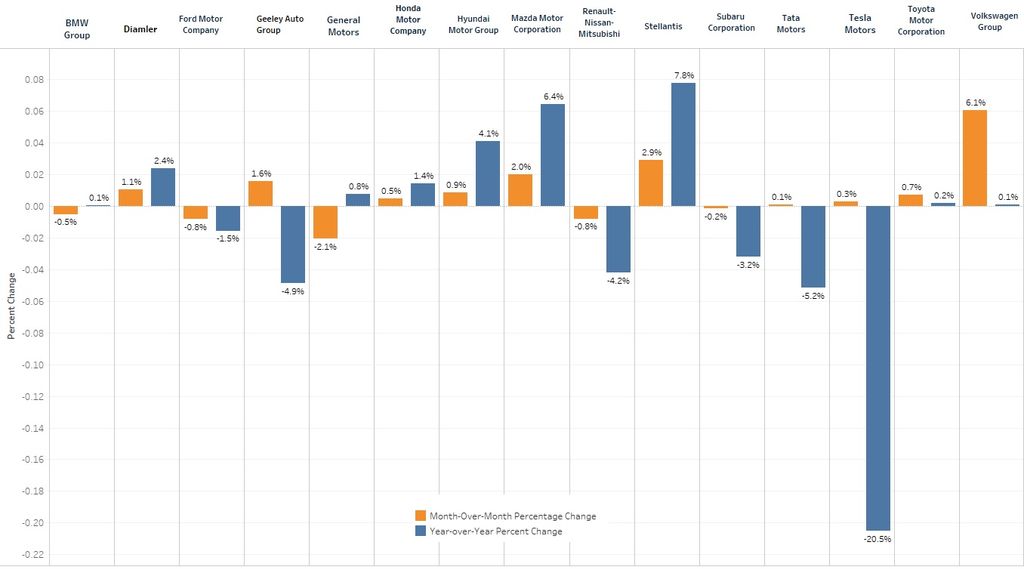

Another interesting takeaway from this data set is that Tesla saw the highest year-over-year price change percentage of all the automakers: minus 20.5%. That's obviously due to the many price cuts the EV maker has made since December 2022.

However, compared to October, Tesla's ATP in November remained almost unchanged at $53,756 versus $53,606 (a 0.3% increase). To learn more about the average transaction prices for automakers, brands, or various categories of vehicles, check out the data tables.